Just like every penny counts in trading, understanding OKX’s fee structure can save you thousands of dollars annually. Your success in cryptocurrency trading doesn’t only depend on making the right market calls – it’s equally about minimizing costs on each transaction. In this comprehensive guide, you’ll discover how to reduce your trading fees by up to 40% on OKX, navigate between different fee tiers, and leverage maker-taker rates to your advantage. Whether you’re a day trader or long-term investor, these strategies will help maximize your trading profitability.

Key Takeaways:

- OKX offers tiered fee structures based on trading volume, with maker fees ranging from 0.080% to 0.000% and taker fees from 0.100% to 0.020%, making it competitive among major exchanges

- Users can reduce trading costs by holding OKB tokens, using spot-margin trading, and maintaining higher 30-day trading volumes to unlock better fee tiers

- VIP users who trade over $5 million in 30-day volume receive additional benefits including lower fees, dedicated support, and exclusive market insights

The Financial Stakes: Why OKX Trading Fees Shouldn’t Be Ignored

Trading fees directly impact your bottom line, with even small percentage differences adding up to substantial amounts over time. For high-frequency traders executing multiple positions daily, a 0.1% fee difference can mean thousands of dollars annually. OKX’s fee structure affects both spot and derivatives trading, making it imperative to understand how these costs compound across your entire trading portfolio.

Dissecting the OKX Fee Structure

OKX employs a maker-taker model where maker fees range from 0.08% to 0.02%, and taker fees span from 0.10% to 0.05%. Your VIP level, determined by your 30-day trading volume and OKB token holdings, influences these rates. Higher tiers offer progressively better rates, with professional traders potentially saving up to 80% compared to base fees.

Assessing the Real Impact of Trading Fees on Your Profitability

A $10,000 trade at the base taker fee of 0.10% costs you $10, while the same trade at VIP level 5 (0.06%) costs only $6. Over 100 similar trades, you’d save $400 – enough to significantly boost your overall returns or fund additional positions.

Looking deeper at profitability impact, consider a scenario where you make 50 trades monthly with an average position size of $5,000. At base rates, you’d spend $250 monthly on fees, while VIP level 3 would reduce this to $175. The annual difference of $900 could cover your trading platform subscriptions or contribute to your risk management buffer. Regular fee assessment becomes particularly vital during high-volatility periods when rapid position adjustments are necessary.

Unpacking the Costs: A Detailed Examination of OKX Trading Fees

Analyzing Spot Trading Fees

OKX operates a tiered maker-taker fee structure for spot trading, starting at 0.10% for takers and 0.08% for makers. Your trading volume directly impacts these rates – reaching $5 million in 30-day volume can reduce your fees to 0.06% taker and 0.04% maker. Holding OKB tokens provides an additional 20% discount on these base rates.

Navigating Futures and Perpetual Swaps Fees

Futures and perpetual swap contracts on OKX carry a base fee of 0.05% for takers and 0.02% for makers. VIP traders can access rates as low as 0.015% taker and 0.005% maker, determined by trading volume and OKB holdings.

The fee structure includes funding rates for perpetual swaps, calculated every 8 hours. Long positions pay short positions when the rate is positive, and vice versa. These rates can significantly impact your overall trading costs, especially during high market volatility periods. Market makers receive rebates for providing liquidity, while high-frequency traders benefit from reduced fees through the platform’s institutional programs.

Understanding Margin Trading Costs

Margin trading includes both trading fees and interest rates on borrowed funds. The daily interest rate starts at 0.03%, with lower rates available for VIP users and those staking OKB tokens.

Your margin trading expenses depend on leverage levels and holding periods. For example, a 5x leveraged position held for 7 days with a base interest rate of 0.03% results in approximately 1.05% in interest charges. The platform offers interest rate discounts of up to 20% for users maintaining substantial OKB holdings or achieving higher VIP levels through consistent trading volume.

Options Trading: What to Expect in Terms of Fees

Options trading fees follow a similar maker-taker model, with base rates of 0.03% for takers and 0.01% for makers. Premium settlement fees are fixed at 0.02%, regardless of your trading tier.

The options fee structure incorporates exercise fees and settlement costs. Exercise fees are charged at 0.02% of the notional value for both calls and puts. Market makers receive competitive rebates for providing options liquidity, particularly during low-volatility periods. Users can reduce their effective options trading costs by combining VIP tier benefits with OKB token discounts, potentially saving up to 25% on standard rates.

Deposit and Withdrawal Fees: Hidden Costs to Watch

Cryptocurrency deposits are free, but withdrawal fees vary by asset. Bitcoin withdrawals cost 0.0004 BTC, while Ethereum withdrawals are set at 0.001 ETH. Network congestion can affect these rates.

Blockchain network fees fluctuate based on network activity and your chosen transaction speed. OKX offers dynamic fee adjustment options, allowing you to balance cost against confirmation speed. During peak periods, selecting a lower priority can save up to 50% on withdrawal fees. The platform updates withdrawal fees weekly to reflect network conditions and maintains different fee structures for various chains of the same asset – for instance, USDT withdrawals cost less on TRC20 than ERC20.

Unlocking Discounts: Maximizing Benefits Through OKX VIP Tiers

The Functionality of OKX VIP Levels

OKX’s VIP program operates on a tier-based system, starting from VIP 0 to VIP 5. Each level requires specific trading volume and OKB token holdings to unlock progressively better fee rates. Your 30-day trading volume and OKB balance determine your tier, with benefits including reduced maker and taker fees, exclusive support channels, and enhanced API limits.

Fee Reduction Strategies Based on Your Tier

Your VIP tier directly influences your trading costs, with maker fees dropping from 0.08% at VIP 0 to as low as 0.02% at VIP 5. Taker fees follow a similar pattern, decreasing from 0.10% to 0.03% across tiers.

To maximize your fee reductions, consider combining your VIP tier benefits with OKB token holdings. For example, holding 500 OKB while maintaining VIP 2 status can result in an additional 10% fee discount. Market makers can further optimize their costs by placing limit orders, which typically incur lower fees than market orders. Regular traders should aim for higher VIP tiers by consolidating their trading volume on OKX rather than spreading it across multiple exchanges.

Accelerating Your Ascent Through the VIP Ranks

Strategic trading volume management and OKB token accumulation can fast-track your progression through VIP levels. Focus on high-volume pairs and maintain consistent trading activity to reach higher tiers more quickly.

To expedite your VIP tier advancement, consider implementing a structured approach. Start by calculating your average monthly trading volume and set realistic targets for the next tier. Utilize OKX’s spot-futures arbitrage opportunities to increase your trading volume while maintaining profitability. Holding OKB tokens provides an immediate boost to your tier benefits – acquiring and maintaining a position of at least 1000 OKB can accelerate your progression by one full VIP level. Additionally, participating in OKX’s trading competitions and promotional events can contribute to your monthly volume requirements.

Side-by-Side Fee Comparison: OKX vs. Competitors

Platform | Maker/Taker FeesOKX | 0.08%/0.10% (Basic)Binance | 0.10%/0.10% (Standard)Coinbase Pro | 0.40%/0.60% (Basic)Kraken | 0.16%/0.26% (Starter)

OKX vs. Binance: Who Offers Better Value?

OKX edges out Binance with slightly lower maker fees at 0.08% compared to Binance’s 0.10%. Both platforms offer competitive VIP tiers, but OKX provides additional fee reductions through their loyalty program. Your trading volume of $50,000+ monthly on OKX unlocks maker fees as low as 0.06%, while Binance requires $100,000+ for similar rates.

Placing OKX Against Coinbase Pro

OKX delivers substantially lower fees than Coinbase Pro across all trading tiers. Your basic trading on OKX costs just 0.10% compared to Coinbase Pro’s 0.60% taker fee – representing a potential 83% reduction in trading costs.

The savings become even more pronounced with higher trading volumes. While Coinbase Pro’s fees bottom out at 0.08%/0.30% for traders moving over $500M monthly, OKX users can achieve rates as low as 0.02%/0.05% at significantly lower volume requirements of $100M+. Your cost advantage using OKX grows exponentially with trading frequency.

Examining Kraken’s Fee Structure in Relation to OKX

Kraken’s base fees start at 0.16%/0.26%, making OKX’s 0.08%/0.10% structure nearly 50% more cost-effective for your regular trading. The gap widens further when considering OKX’s more generous volume-based discounts and additional rebate opportunities.

The platform differences become particularly notable in futures trading, where OKX maintains competitive rates while Kraken charges premium fees. Your futures contracts on OKX benefit from unified spot/futures fee tiers, whereas Kraken separates these structures, potentially increasing your overall trading costs.

Other Noteworthy Platforms to Consider

Platforms like KuCoin and Huobi offer comparable base fees to OKX, but lack the comprehensive reward system and trading fee optimization tools. Your trading on these alternatives might save marginally on specific pairs but miss out on OKX’s holistic cost advantages.

The competitive landscape includes emerging platforms like ByBit and FTX, each with unique fee structures. However, OKX maintains an edge through its combination of competitive base rates, volume-based discounts, and innovative fee reduction mechanisms. Your trading strategy might benefit from comparing these alternatives, but OKX consistently ranks among the most cost-effective options, especially for regular traders seeking long-term fee optimization.

Cutting Costs: Proven Strategies to Lower Your Trading Fees

Using OKB for Automatic Discounts

Holding OKB tokens in your OKX account automatically reduces your trading fees by up to 40%. The discount tier system starts at 100 OKB tokens for a 10% reduction, scaling up to 2000+ OKB for the maximum benefit. Your OKB holdings are calculated daily, making this a passive way to slash trading costs while potentially benefiting from the token’s value appreciation.

Timing Your Trades: Finding the Sweet Spot for Lowest Fees

Market volatility and trading volume directly impact fee structures on OKX. Trading during off-peak hours (typically 00:00-04:00 UTC) often results in lower slippage and better execution prices. Additionally, OKX occasionally offers reduced fees during specific trading windows or market events.

By analyzing trading patterns, you can identify optimal trading windows that combine favorable fee conditions with good market liquidity. The platform’s trading heat map shows peak activity periods, helping you plan your trades accordingly. Weekend trading often presents better fee opportunities due to reduced institutional trading volume.

Leveraging High-Volume Trading Rebates

OKX rewards high-volume traders with progressive rebates, starting at $50,000 monthly trading volume. Your rebate tier increases with volume, potentially reaching up to 0.025% cashback on maker orders. These rebates stack with other discounts, maximizing your fee savings.

The rebate system operates on a 30-day rolling basis, calculating your total trading volume across all spot and derivatives markets. Meeting higher volume thresholds unlocks VIP status levels, each offering increasingly attractive rebate rates. For instance, reaching VIP 2 status with $100,000 monthly volume provides a 0.02% maker rebate and 0.05% taker fee reduction.

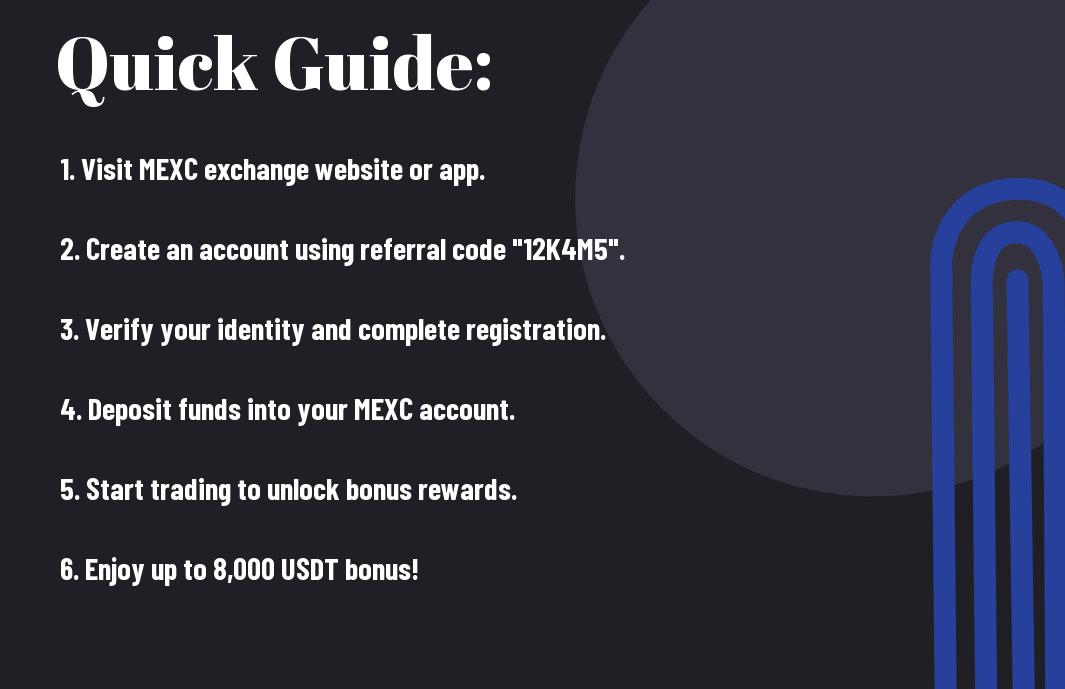

The Advantages of Using Referral Code 67374754

Entering referral code 67374754 during account creation unlocks an immediate 20% fee discount for your first month of trading. This code also provides access to exclusive trading competitions and bonus rewards, enhancing your overall trading experience.

Beyond the initial discount, this referral code connects you to a network of experienced traders and community events. You’ll receive priority access to new feature launches, educational resources, and special promotional offers. The code’s benefits compound with other discount programs, potentially reducing your effective trading fees by up to 65% when combined with OKB holdings and VIP status.

To wrap up

Hence, your trading experience on OKX can be significantly more cost-effective when you understand and utilize the platform’s fee structure wisely. By maintaining higher trading volumes, holding OKB tokens, and taking advantage of VIP tiers, you can reduce your trading costs substantially. The maker-taker model, combined with various discount programs, gives you multiple opportunities to minimize fees on every trade. Armed with this knowledge, you’re now ready to make informed decisions that will help you maximize your profits while keeping transaction costs low on OKX.

FAQ

Q: What are the basic trading fees on OKX compared to other major exchanges?

A: OKX offers competitive trading fees starting at 0.10% for makers and 0.15% for takers on spot trading, which is lower than Binance (0.10%/0.10%) and Coinbase (0.40%/0.60%). VIP users with higher trading volumes can receive even better rates, going as low as 0.02% maker and 0.05% taker fees. Additionally, using OKB tokens for fee payments provides an extra 20% discount.

Q: How can I reduce my trading fees on OKX in 2025?

A: You can minimize your OKX trading fees through multiple methods: holding OKB tokens for up to 20% discount, increasing your 30-day trading volume to reach VIP levels, using maker orders instead of taker orders, and participating in special promotional events. Also, enabling the “Pay fees with OKB” option in your account settings automatically applies available discounts.

Q: What are the differences between OKX’s spot, futures, and margin trading fees?

A: OKX implements different fee structures across trading types. Spot trading starts at 0.10%/0.15% (maker/taker), futures trading begins at 0.02%/0.05%, and margin trading includes additional interest rates ranging from 0.02% to 0.05% daily. Futures and margin trading offer lower base fees but come with additional costs like funding rates and interest charges. Professional traders can benefit from reduced fees in all categories by maintaining higher trading volumes.