Profits in cryptocurrency trading heavily depend on your ability to manage trading fees effectively. As you navigate the CoinEx platform, understanding the fee structure can be the difference between profitable trades and diminishing returns. This comprehensive guide will show you how to reduce your trading costs by up to 50% through maker-taker fees, VIP levels, and CET token benefits. You’ll discover proven strategies to optimize your trading approach while avoiding hidden charges that could eat into your potential gains.

Key Takeaways:

- CoinEx operates a tiered fee structure where higher trading volumes unlock lower fees, with maker fees ranging from 0.2% to 0.02% and taker fees from 0.2% to 0.06%

- Traders can reduce costs by holding CET tokens, using limit orders instead of market orders, and maintaining higher 30-day trading volumes to qualify for better fee tiers

- Spot trading fees are generally lower than futures and margin trading fees on CoinEx, making it imperative to consider the trading type when planning cost-effective strategies

Demystifying the CoinEx Fee Structure

CoinEx employs a tiered fee structure that rewards higher trading volumes with lower fees. The base maker and taker fees start at 0.2% and decrease based on your 30-day trading volume and CET holdings. Users can reduce their trading costs by up to 50% by holding CET tokens in their account, making it a valuable strategy for frequent traders.

The Dynamics of Maker vs. Taker Fees

Maker orders add liquidity to the order book by placing limit orders that don’t immediately execute, while taker orders remove liquidity by matching existing orders. Maker fees are consistently lower than taker fees, starting at 0.2% for takers and 0.1% for makers. Your trading strategy directly impacts which fee category applies to your trades.

Navigating the Fee Schedule Based on Trading Volume

Trading volume tiers on CoinEx range from Level 1 (under 50,000 USDT monthly volume) to Level 9 (over 150 million USDT). Each tier unlocks progressively lower fees, with the highest tier offering maker fees as low as 0.02% and taker fees of 0.04%. Your 30-day trading volume automatically determines your tier placement.

To maximize your fee advantages, monitor your current tier status through your account dashboard. Moving up tiers requires consistent trading activity – for example, reaching Level 5 needs a monthly volume of 1 million USDT and reduces your maker fees to 0.08%. Combining high-volume trading with CET holdings can result in the lowest possible fees, potentially saving thousands in trading costs annually.

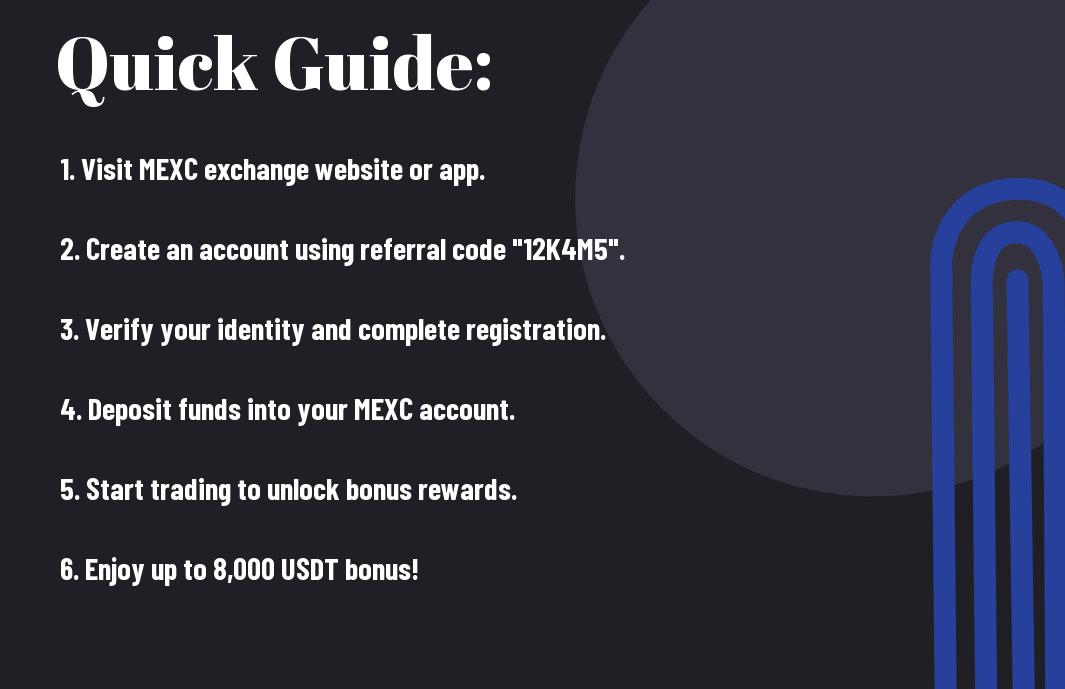

Unlocking Value with the Referral Code g69h3

Take advantage of CoinEx’s referral program by using code g69h3 during registration to instantly unlock premium trading benefits. This exclusive code grants you access to reduced trading fees and additional platform perks, setting you up for more cost-effective trading from day one.

Instant Fee Reductions for New Sign-Ups

New users who register with referral code g69h3 receive an immediate 20% reduction in trading fees across all pairs. Your base maker fees drop to 0.16% and taker fees to 0.18%, allowing you to start trading with significantly lower costs compared to standard accounts.

Reciprocal Rewards Through Referrals

After joining CoinEx, you’ll receive your own unique referral code to share with other traders. For each person who signs up using your code, you earn 30% of their trading fees as commission, creating a passive income stream while helping others access reduced fees.

The referral system operates on a tiered structure, where your earnings increase based on your referrals’ trading volume. Level 1 referrals generate direct commissions, while Level 2 referrals (people invited by your referrals) earn you 10% commission. Your referral dashboard tracks all earnings and allows for instant withdrawals once you reach the minimum threshold of 10 USDT.

Maximizing Discount Potential with CET Tokens

Harnessing CET Token Assets to Lower Fees

Holding CET tokens directly reduces your trading costs on CoinEx through their tiered discount system. By maintaining a balance of 10,000 CET or more, you can access fee reductions of up to 30% on all trades. The discount increases proportionally with your CET holdings – reaching the maximum tier requires 1 million CET tokens, unlocking the full suite of trading benefits and premium features.

Synergizing CET Discounts with Referral Benefits

Combining CET token holdings with CoinEx’s referral program creates a powerful cost-reduction strategy. Your base discount from CET tokens stacks with the 20% commission rebates earned through referrals. For example, if you hold 50,000 CET (15% discount) and maintain an active referral network, your effective trading fees could drop below 0.08%.

The referral system operates on a multi-tier structure, where you earn commissions from both direct referrals and their subsequent trading activities. Level 1 referrals generate 20% commission sharing, while Level 2 referrals provide 10%. By building a substantial referral network while holding CET tokens, you can potentially eliminate most trading fees and even generate passive income through commission rebates. The system rewards active traders who contribute to the platform’s liquidity and community growth.

Strategic Approaches to Minimize Trading Costs

The Advantages of Limit Orders Over Market Orders

Limit orders give you precise control over your entry and exit prices, helping you avoid unnecessary fees from price slippage. By setting specific price points, you’ll pay exactly what you intend to pay, unlike market orders which execute at the current best available price. Limit orders can save you up to 0.1% per trade compared to market orders, especially during volatile market conditions when spreads tend to widen.

Capitalizing on Fee-Free Trading Promotions

CoinEx regularly offers zero-fee trading periods on selected trading pairs, typically lasting 7-14 days. These promotions can save you up to 0.2% per trade, allowing you to execute high-volume strategies without fee concerns. Monitor the CoinEx announcement page and social media channels to catch these opportunities early.

Fee-free promotions often coincide with new token listings or market events. To maximize these opportunities, prepare your trading strategy in advance and ensure sufficient funds are available in your account. Set price alerts for your target trading pairs and consider increasing your usual trading volume during these periods. Past promotions have included popular pairs like BTC/USDT and ETH/USDT, with some users reporting savings of thousands of dollars during extended zero-fee events.

Practical Fee Calculation Scenarios

Comparative Analysis: Spot Trading Example

Let’s break down a real-world spot trading scenario to illustrate your potential savings. Trading $10,000 worth of BTC/USDT at the standard 0.1% fee would cost you $10, but with CET holdings and VIP status, you could reduce this to as low as 0.02%, paying only $2 per trade – a dramatic 80% reduction in trading costs.

Fee Comparison Table

| Trading Level | Fee Cost per $10,000 |

|---|---|

| Standard (0.1%) | $10 |

| VIP 3 + CET (0.02%) | $2 |

Exploring Futures Trading Costs in Depth

Futures trading on CoinEx operates on a maker-taker model with base fees of 0.02% for makers and 0.05% for takers. Your effective rates can drop to as low as 0.01% maker and 0.03% taker through VIP levels and CET holdings. For a $50,000 futures position, this translates to a maximum saving of $20 per trade compared to standard rates.

The fee structure for futures also includes overnight funding rates, typically charged every 8 hours. These rates fluctuate based on market conditions and can range from -0.01% to 0.01%, directly impacting your long-term holding costs. Monitoring these funding rates carefully helps optimize your trading strategy and potentially earn additional income during negative rate periods.

Summing up

Considering all points, your success in CoinEx trading heavily depends on understanding and optimizing fee structures. By maintaining higher trading volumes, utilizing CXT tokens, and choosing maker orders, you can significantly reduce your trading costs. The platform’s tiered fee system rewards your active participation, while spot and futures markets offer different opportunities for fee optimization. When you combine these strategies with the VIP program benefits, you’ll position yourself for more profitable trades through 2025 and beyond.

FAQ

Q: What are the basic trading fee rates on CoinEx in 2025?

A: CoinEx operates with a tiered fee structure where maker fees start at 0.2% and taker fees at 0.2% for regular users. VIP users can enjoy reduced rates based on their 30-day trading volume and CET holdings, with fees potentially dropping as low as 0.02% for makers and 0.06% for takers at the highest VIP levels.

Q: How can I reduce my trading fees on CoinEx?

A: You can minimize trading fees by holding CET tokens, CoinEx’s native cryptocurrency, which provides up to a 25% fee discount. Additionally, maintaining higher trading volumes to reach VIP levels, using limit orders instead of market orders to act as a maker, and participating in promotional events can significantly lower your trading costs.

Q: What payment methods offer the lowest deposit and withdrawal fees on CoinEx?

A: Cryptocurrency deposits on CoinEx are generally free, while withdrawal fees vary by asset. Using TRC-20 USDT typically offers the lowest withdrawal fees compared to ERC-20 tokens. For fiat transactions, bank transfers often provide better rates than credit card purchases, which can incur fees up to 3.5%. Some cryptocurrencies offer minimal network fees, making them cost-effective options for moving funds.