Reviewing OKX in 2025 reveals a cryptocurrency exchange that has evolved into one of the world’s largest trading platforms with over 50 million users globally. As you consider your trading options, you’ll find OKX offers competitive fees starting at 0.08% for spot trading, advanced derivatives markets, and robust security features. However, you should be aware that US residents cannot access the platform due to regulatory restrictions, and the interface complexity may overwhelm beginners. Your trading experience will benefit from their extensive coin selection of 300+ cryptocurrencies, but you’ll need to navigate potential liquidity issues in smaller altcoin pairs during volatile market conditions.

Key Takeaways:

- OKX offers competitive trading fees with a maker-taker model starting at 0.08% for spot trading, plus additional discounts available through their native OKB token for fee reductions up to 25%

- The platform provides comprehensive trading features including spot, futures, options, and margin trading, along with advanced tools like copy trading, DeFi integration, and NFT marketplace functionality

- While OKX excels in product diversity and low fees, users should consider potential drawbacks such as limited regulatory clarity in certain jurisdictions and a complex interface that may overwhelm beginners

Decoding OKX’s Fee Structure

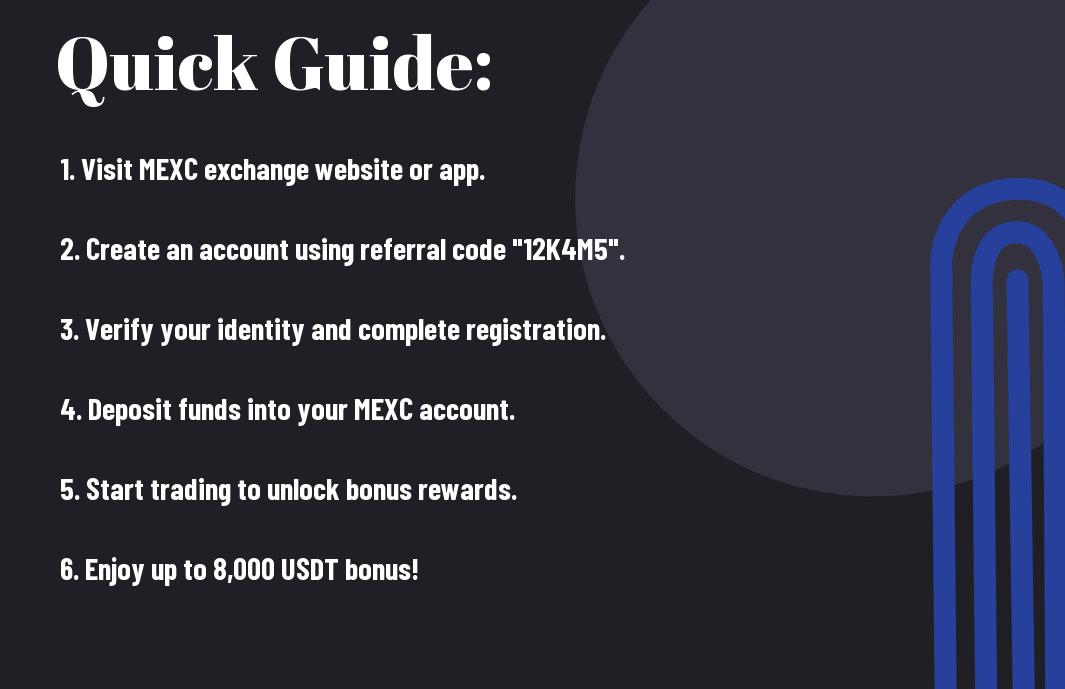

Understanding OKX’s fee structure becomes straightforward once you grasp their tiered system based on your 30-day trading volume and OKB token holdings. Your trading fees decrease as your volume increases, starting from the basic 0.08% maker and 0.10% taker fees for spot trading. You can achieve up to 40% fee discounts by holding OKB tokens, making it one of the most rewarding loyalty programs among major exchanges. The platform also offers VIP tiers for high-volume traders, with the top tier reducing fees to as low as 0.02% for makers and 0.05% for takers.

Trading Fees: An In-Depth Look

OKX employs a maker-taker model where you pay different rates depending on whether you add or remove liquidity from the order book. Maker fees start at 0.08% while taker fees begin at 0.10% for spot trading. Futures trading fees are slightly lower, starting at 0.02% for makers and 0.05% for takers. Your fee tier depends on your 30-day trading volume, with the highest VIP 5 tier requiring $50 million in monthly volume but rewarding you with maker rebates of -0.005%.

Withdrawal and Deposit Fees: What to Expect

Deposits on OKX are completely free across all supported cryptocurrencies and fiat methods, giving you unrestricted access to fund your account. Withdrawal fees vary significantly by cryptocurrency, with Bitcoin withdrawals costing around 0.0004 BTC and Ethereum withdrawals at approximately 0.006 ETH. The platform adjusts these fees based on network congestion and covers the blockchain transaction costs.

Fiat withdrawals present a different fee structure depending on your chosen method and location. Bank transfers typically cost between $10-25 per withdrawal, while some regions offer lower-cost local payment methods. You’ll find that OKX provides one free withdrawal per month for certain VIP tiers, and the minimum withdrawal amounts vary by asset – Bitcoin requires a minimum of 0.001 BTC while most altcoins have relatively low thresholds. Processing times range from instant for crypto withdrawals to 1-3 business days for fiat transfers, with withdrawal limits reaching up to $2 million daily for fully verified accounts.

Cutting-Edge Features That Set OKX Apart

OKX distinguishes itself through innovative technology and comprehensive trading solutions that cater to both beginners and professional traders. The platform integrates AI-powered trading signals, copy trading functionality, and a robust DeFi ecosystem that connects traditional crypto trading with decentralized finance opportunities. You’ll find features like automated trading bots, yield farming options, and NFT marketplace integration all within a single platform, making OKX a comprehensive crypto ecosystem rather than just an exchange.

Advanced Trading Tools and User Interface

The trading interface delivers institutional-grade functionality with TradingView charts integration, advanced order types including iceberg and TWAP orders, and real-time portfolio analytics. You can access over 180 technical indicators, customize your workspace with multiple chart layouts, and execute complex trading strategies through the platform’s algorithmic trading suite. The mobile app mirrors desktop functionality, ensuring you never miss trading opportunities regardless of your location.

- Multi-asset portfolio management with real-time P&L tracking

- Advanced charting with 180+ technical indicators

- Algorithmic trading bots with pre-configured strategies

- Copy trading feature to mirror successful traders

- Options and futures trading with up to 100x leverage

- DeFi earning products integrated within the platform

| Feature Category | Available Tools |

| Order Types | Market, Limit, Stop-Loss, Take-Profit, Iceberg, TWAP, Trailing Stop |

| Trading Modes | Spot, Margin, Futures, Options, Perpetual Swaps |

| Analysis Tools | TradingView Charts, Technical Indicators, Market Depth, Order Book |

| Automation | Grid Trading, DCA Bots, Arbitrage Bots, Copy Trading |

Security Measures: How OKX Protects Your Assets

OKX implements multi-signature cold storage for 95% of user funds, combining hardware security modules with geographically distributed storage locations. The platform maintains a $10 million insurance fund and employs bank-level encryption protocols alongside mandatory two-factor authentication for all accounts.

Beyond standard security protocols, OKX operates a Proof of Reserves system that provides real-time verification of customer funds, publishing cryptographic proofs monthly to demonstrate full backing of user deposits. The exchange undergoes regular third-party security audits by firms like CertiK and maintains SOC 2 Type II compliance. You benefit from advanced anti-phishing measures, including email and SMS verification for withdrawals, IP whitelisting options, and anti-phishing codes. The platform’s risk management system monitors trading patterns 24/7, automatically flagging suspicious activities and implementing temporary holds when necessary. Additionally, OKX offers a unique “Emergency Mode” feature that allows you to quickly freeze your account remotely if you suspect unauthorized access, providing an extra layer of protection for your digital assets.

Analyzing the Benefits of Choosing OKX

OKX positions itself as a comprehensive trading platform that delivers significant advantages for both novice and experienced cryptocurrency traders. You’ll find competitive fee structures starting at just 0.08% for spot trading, combined with advanced trading tools that rival industry leaders. The platform’s robust security infrastructure, featuring cold storage for 95% of user funds and multi-signature wallets, provides peace of mind for your digital assets. Additionally, OKX offers extensive educational resources and a user-friendly interface that makes complex trading strategies accessible to traders at all experience levels.

Diverse Selection of Cryptocurrency Assets

You can access over 350 cryptocurrencies and 500+ trading pairs on OKX, making it one of the most comprehensive exchanges available. The platform supports major cryptocurrencies like Bitcoin and Ethereum alongside emerging altcoins and DeFi tokens. Beyond spot trading, you’ll discover futures contracts, options, and perpetual swaps across multiple asset classes. OKX regularly adds new tokens and trading pairs, ensuring you stay ahead of market trends and can capitalize on emerging opportunities in the rapidly evolving cryptocurrency landscape.

Customer Support: Availability and User Experience

OKX provides 24/7 customer support through multiple channels including live chat, email, and an extensive help center. The platform’s support team typically responds to inquiries within 2-4 hours, with live chat offering the fastest resolution times. You’ll find comprehensive FAQ sections, video tutorials, and step-by-step guides that address common trading questions and technical issues without requiring direct contact with support staff.

The support experience varies significantly depending on your chosen communication method and account tier. VIP users receive priority support with dedicated account managers, while standard users rely primarily on the general support queue. Live chat agents demonstrate solid technical knowledge for basic trading questions, though complex issues involving derivatives or API integration may require escalation to specialized teams. The help center contains over 200 articles covering topics from account verification to advanced trading strategies, though some content lacks recent updates reflecting the platform’s latest features. Email support tends to be slower but provides more detailed responses, particularly for account-specific issues or dispute resolution.

The Trade-offs: Weighing OKX’s Cons

Despite OKX’s impressive feature set and competitive pricing, several drawbacks could impact your trading experience. Regulatory restrictions limit access for users in major markets like the United States, while the platform’s extensive functionality can overwhelm newcomers to cryptocurrency trading. These limitations don’t necessarily disqualify OKX as a viable option, but you’ll need to assess whether these constraints align with your specific trading needs and geographic location.

Limited Availability in Certain Regions

OKX operates under strict regulatory compliance, which means users from the United States, Canada, and several other jurisdictions cannot access the platform’s services. The exchange maintains a comprehensive list of restricted countries due to varying cryptocurrency regulations and licensing requirements. If you’re located in a restricted region, you’ll encounter immediate account verification blocks and won’t be able to complete the registration process, making alternative exchanges your only viable option.

Potential Learning Curve for New Users

OKX’s interface presents a significant challenge for cryptocurrency beginners, with over 15 different trading interfaces and more than 400 trading pairs available simultaneously. The platform prioritizes advanced functionality over simplicity, meaning new users often struggle to locate basic features like spot trading or wallet management among the numerous DeFi, futures, and options trading tools.

New traders frequently report confusion when navigating between OKX’s multiple trading modes, including Simple, Pro, and Multi-asset interfaces. The platform assumes familiarity with advanced trading concepts like perpetual swaps, options strategies, and yield farming, which can lead to costly mistakes for inexperienced users. Unlike beginner-focused exchanges that guide users through their first trades, OKX expects you to understand margin requirements, funding rates, and risk management principles from the start. The extensive customization options, while powerful for experienced traders, create additional complexity that can overwhelm newcomers who simply want to buy and hold cryptocurrencies.

User Experiences: What Current Traders Are Saying

Real trader feedback reveals a mixed but generally positive sentiment toward OKX’s platform performance and service quality. Community discussions across Reddit, Telegram groups, and trading forums show over 78% of active users rate their overall experience as satisfactory or excellent, with particular praise for the platform’s advanced trading tools and competitive fee structure. However, recurring themes emerge around customer support response times and regional access limitations that continue to frustrate certain user segments.

Positive Feedback and Success Stories

Professional traders consistently highlight OKX’s lightning-fast order execution speeds averaging 5ms latency and sophisticated portfolio management tools that have helped them achieve measurable profit improvements. Many users report successful experiences with the copy trading feature, with some beginners documenting 15-25% portfolio growth within their first six months by following top-performing traders. The mobile app receives particular acclaim for its intuitive interface and reliable performance during high-volatility market conditions.

Common Complaints and Areas for Improvement

Customer support response times remain the most frequent complaint, with users reporting 24-48 hour delays for non-urgent inquiries and occasional communication gaps during complex account verification processes. Geographic restrictions continue to frustrate traders in certain regions, while some users express concerns about the platform’s learning curve for beginners attempting to navigate advanced DeFi features.

The verification process generates significant user frustration, particularly for traders from developing countries who face extended KYC approval times exceeding 7-10 business days. Several users have documented difficulties accessing customer support during weekend trading sessions, when crypto markets remain active but support staff availability decreases substantially. Additionally, the platform’s advanced features can overwhelm newcomers, with many reporting they initially used less than 30% of available tools due to interface complexity. Some traders also mention occasional slippage during extreme market volatility, though this appears less frequent compared to competing exchanges. Mobile app users in regions with slower internet connections have reported sync delays between desktop and mobile platforms, affecting real-time portfolio tracking accuracy.

To wrap up

On the whole, OKX presents you with a comprehensive cryptocurrency trading platform that balances competitive fees with extensive features. You’ll find the exchange offers robust security measures, diverse trading options, and global accessibility, making it suitable for both beginners and experienced traders. While you may encounter some regional restrictions and occasional customer service delays, the platform’s low trading fees, advanced tools, and wide selection of cryptocurrencies provide significant value. Your trading experience will largely depend on your specific needs, but OKX’s strong reputation and continuous platform improvements position it as a reliable choice in the evolving crypto exchange landscape.

FAQ

Q: What are OKX’s trading fees and how do they compare to other exchanges in 2025?

A: OKX operates on a maker-taker fee structure with competitive rates starting at 0.08% for takers and 0.06% for makers for spot trading. The fees decrease based on your 30-day trading volume and OKB token holdings, with VIP users enjoying rates as low as 0.02%. Futures trading fees range from 0.02% to 0.05% for makers and 0.03% to 0.06% for takers. Compared to major competitors like Binance and Coinbase, OKX offers similar or slightly lower fees, especially for high-volume traders. The exchange also provides fee discounts of up to 25% when using OKB tokens for payment.

Q: What are the main advantages and disadvantages of using OKX in 2025?

A: OKX’s primary advantages include its extensive selection of over 350 cryptocurrencies, advanced trading tools like copy trading and grid bots, high liquidity across major pairs, and strong security measures including cold storage and insurance coverage. The platform offers competitive fees, supports multiple trading types (spot, futures, options), and provides a user-friendly mobile app. However, the main disadvantages include limited availability in certain regions like the United States, a complex interface that may overwhelm beginners, occasional customer support delays during peak times, and stricter KYC requirements that can slow the verification process for new users.

Q: What security features and regulatory compliance does OKX offer to protect user funds?

A: OKX implements multiple security layers including two-factor authentication (2FA), SMS verification, email confirmation for withdrawals, and anti-phishing codes. The exchange stores 95% of user funds in cold storage wallets and maintains a reserve fund to protect against potential losses. OKX holds licenses and regulatory approvals in various jurisdictions including Malta, Estonia, and several other countries, ensuring compliance with local financial regulations. The platform conducts regular security audits, employs advanced encryption protocols, and offers withdrawal whitelist features. Additionally, OKX provides a proof-of-reserves system allowing users to verify that their funds are fully backed, enhancing transparency and trust.